When making decisions to enter an industrial project, especially the establishment of factories in the metal and mining sectors, conducting a thorough supply chain analysis in the steel industry is crucial. Early and comprehensive evaluation of steel industry statistics and supply chain data helps reduce significant future risks. This article explores the importance of this process through a hypothetical example.

Supply Chain Analysis in a Hypothetical Project

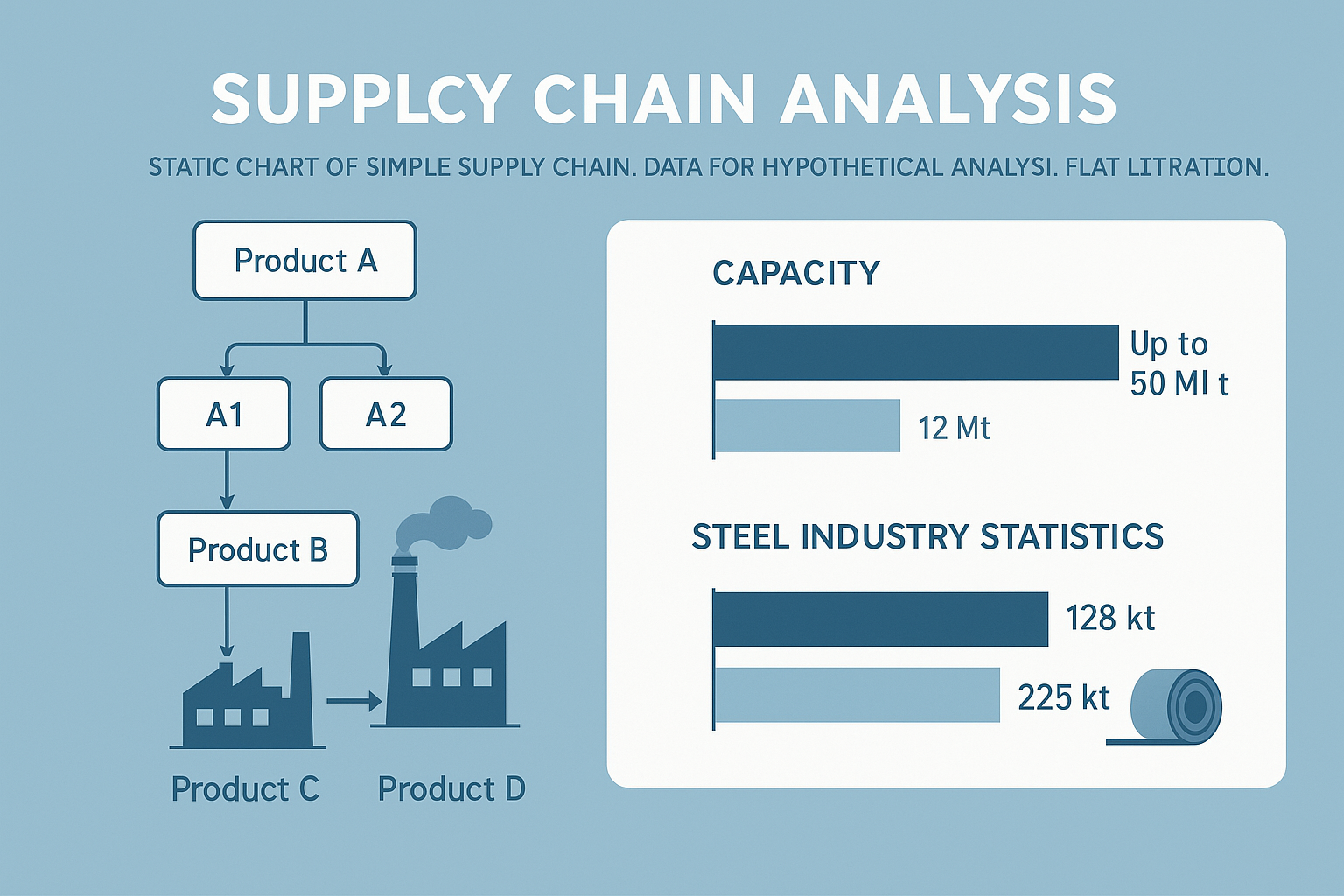

Imagine planning to build a factory producing product B, capable of manufacturing two types of products: B1 and B2, such as thermal coal or coking coal. The raw materials for this factory come from mines (product A), which include two types: A1 and A2. After production, product B is sold to ferroalloy factories (product C), which in turn supply the steel manufacturing industry (product D).

This supply chain consists of four key levels:

-

Miners (A)

-

Coal processing plants (B)

-

Ferroalloy producers (C)

-

Steel manufacturing industry (D)

Conducting a supply chain analysis across these levels is essential for understanding the dependencies and flow of materials.

Steel Industry Statistics and Production Capacity in Iran

To gain insights into the steel market, reviewing Iran’s steel industry statistics is necessary:

-

The steel production capacity in Iran is approximately 32 million tons annually, with potential growth to 50 million tons.

-

Producing this volume of steel requires about 128,000 tons of ferrosilicon. Current production capacity of ferrosilicon is estimated at 225,000 tons, resulting in a surplus of roughly 100,000 tons.

-

Despite the surplus, exports of ferroalloys face challenges due to global price fluctuations, currency policies, and domestic regulations, often resulting in sales below production costs.

-

Producing this amount of ferroalloys demands around 400,000 tons of processed coal (product B), nearly equal to the current national production capacity in this sector.

-

However, raw coal supply (product A), essential for processing plants, faces shortages and relies partly on imports. Price controls and quality issues further complicate procurement, posing risks to the industry.

A detailed supply chain analysis in the steel industry reveals these vulnerabilities and helps stakeholders plan better.

Investment Risks Without Supply Chain Analysis

Investing in building a product B factory without a thorough supply chain analysis can expose investors to multiple risks:

-

Highly competitive market conditions for product B

-

Difficulties and high costs in sourcing raw materials

-

Surplus production and cash flow problems in ferroalloy industries

-

Lack of clear understanding of relationships between supply chain levels leading to financial and operational failures

Therefore, comprehensive supply chain analysis in the steel industry is indispensable to mitigate these risks.

Recommended Strategies to Reduce Investment Risks

To effectively manage risks uncovered through supply chain analysis, investors should consider:

-

Securing raw material supply through long-term contracts or direct investment in mining operations (product A)

-

Establishing stable sales agreements with main buyers (ferroalloy plants – product C)

-

Creating added value by producing by-products or enhancing the quality of product B

Implementing these strategies improves resilience and profitability in steel industry-related projects.

Conclusion

This hypothetical example underscores the critical importance of conducting a detailed supply chain analysis in the steel industry before investing in industrial projects. Ignoring the analysis of steel production capacity and supply chain data risks poor decision-making and financial losses. Thus, integrating real supply chain insights into business planning is essential for long-term success in the steel sector.